The Tesla stock forecast for 2025 holds significant interest. Investors and enthusiasts want to know its future.

Tesla is an industry leader in electric vehicles. Its stock has seen dramatic highs and lows. As we look to 2025, many wonder if the stock will continue to soar or face challenges. Predicting stock performance involves analyzing many factors.

This includes market trends, company performance, and economic conditions. In this blog, we will explore these elements. We will provide a detailed look at what might influence Tesla’s stock in the coming years. Whether you are an investor or simply curious, this forecast will offer valuable insights. Let’s dive into the Tesla stock forecast for 2025 and see what the future might hold.

Introduction To Tesla Stock

Tesla Inc., founded by Elon Musk, is a leader in electric vehicles. Its stock has gained attention from investors worldwide. Understanding Tesla’s market position and historical performance helps in predicting its future stock value. Let’s explore these aspects.

Tesla’s Market Position

Tesla has a strong market position in the electric vehicle (EV) industry. It leads in innovation and technology. Tesla’s cars are known for their high performance and long battery life. This has given the company a competitive edge.

Beyond cars, Tesla is also significant in the renewable energy sector. Its products include solar panels and energy storage solutions. This diversification strengthens its market position.

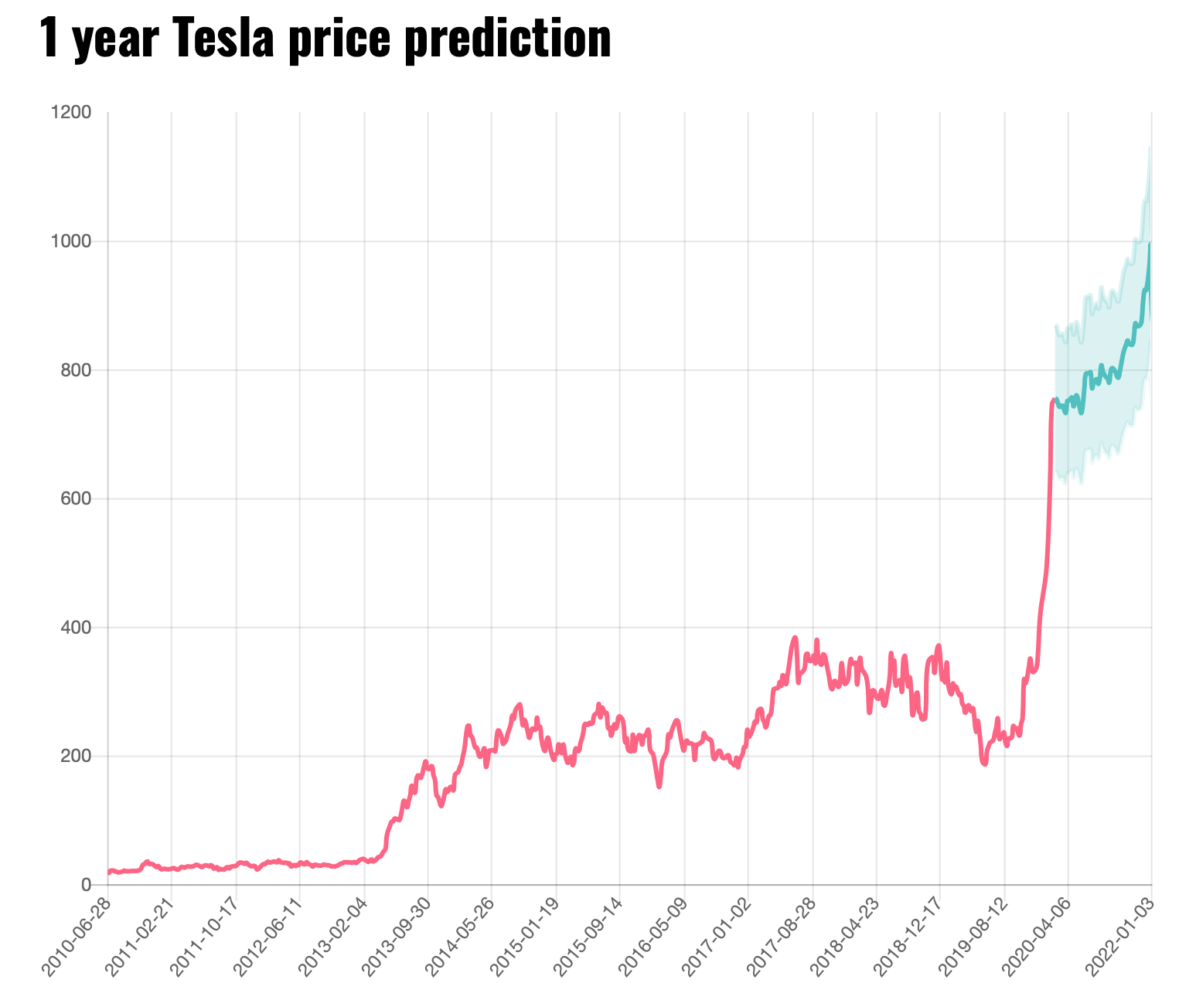

Historical Performance

Examining Tesla’s past performance can offer insights into its future. Tesla’s stock has seen significant growth over the years. Here is a summary of its historical performance:

| Year | Stock Price (USD) | Event |

|---|---|---|

| 2010 | 17 | Initial Public Offering (IPO) |

| 2015 | 220 | Model S Release |

| 2020 | 650 | Stock Split |

| 2023 | 800 | Record Sales |

This table shows Tesla’s stock price growth and key events. Such historical data can help in forecasting future trends. Investors should consider both market position and past performance.

Credit: www.calarestaurante.com

Factors Influencing Tesla’s Future

Understanding Tesla’s stock forecast for 2025 involves looking at several factors. These factors include market trends, technological innovations, and more. Let’s explore how these elements can shape Tesla’s future.

Electric Vehicle Market Trends

The electric vehicle (EV) market is growing rapidly. By 2025, EVs will likely take a larger share of the car market. This growth can influence Tesla’s stock positively.

Governments are pushing for greener transportation. Incentives like tax rebates and grants make EVs more attractive. Tesla stands to benefit from these policies.

Consumer demand for EVs is also increasing. More people want cars that are eco-friendly and cost less to run. Tesla offers a range of models that appeal to these consumers.

Here is a table showing some key market trends:

| Trend | Impact on Tesla |

|---|---|

| Government incentives | Positive |

| Increasing EV demand | Positive |

| More competitors | Mixed |

Technological Innovations

Technological advancements are crucial for Tesla. Continuous innovation can keep Tesla ahead of competitors.

Tesla invests heavily in battery technology. Better batteries mean longer ranges and shorter charging times. This investment can enhance Tesla’s appeal.

Self-driving technology is another focus. Tesla’s Autopilot feature is already popular. Improved autonomous driving can attract more buyers.

Here are some innovations to watch:

- Improved battery life

- Faster charging solutions

- Advanced self-driving features

These innovations can help Tesla maintain its market lead.

Expert Predictions For 2025

Tesla stock predictions for 2025 suggest a mix of optimism and caution. Analysts foresee potential growth driven by new technologies and market expansion. Investors should watch for market trends and Tesla’s strategic decisions.

Predicting Tesla’s stock for 2025 has experts divided. The electric vehicle giant has seen rapid growth. Its future remains a hot topic among investors.

Bullish Predictions

Some experts foresee a bright future for Tesla. They believe the company will continue to innovate. New models and technology may boost sales. Expansion into new markets could also drive growth. These factors may push the stock price higher. Analysts also expect Tesla to lead in self-driving tech. This could create new revenue streams. Clean energy initiatives might further enhance Tesla’s appeal. Investors with a positive outlook see significant gains by 2025.

Bearish Predictions

Not all experts share this optimism. Some predict challenges for Tesla ahead. Competition in the electric vehicle market is growing. New players could eat into Tesla’s market share. Economic factors might also impact Tesla’s performance. Rising interest rates and inflation could slow growth. Production issues and supply chain problems are other concerns. These factors may prevent the stock from rising. Some analysts worry about Tesla’s valuation. They argue the stock is overpriced. A correction could occur if growth doesn’t meet expectations. Investors with a cautious outlook see limited gains by 2025. “`

Credit: www.ccn.com

Financial Analysts’ Opinions

Understanding the financial analysts’ opinions can help investors make informed decisions about Tesla stock. They analyze various factors to predict the stock’s future performance. These opinions can guide your investment strategy for 2025.

Top Analysts’ Forecasts

Several top analysts have shared their predictions for Tesla stock in 2025. Their forecasts are based on various factors including market trends, company performance, and economic conditions.

| Analyst | Firm | 2025 Forecast |

|---|---|---|

| Gene Munster | Loup Ventures | $1,500 |

| Dan Ives | Wedbush | $1,400 |

| Colin Rusch | Oppenheimer | $1,350 |

Consensus Rating

The consensus rating combines the opinions of many analysts. It provides an overall view of Tesla stock’s future. Most analysts have a positive outlook for Tesla in 2025.

- Strong Buy: 20 analysts

- Buy: 10 analysts

- Hold: 5 analysts

- Sell: 2 analysts

- Strong Sell: 1 analyst

The majority of analysts recommend buying Tesla stock. This indicates a strong belief in its growth potential. Investors can consider this when planning their investments for 2025.

Impact Of Global Policies

The Tesla stock forecast for 2025 depends on many factors. One significant factor is global policies. These policies can greatly influence Tesla’s performance. They shape the market and affect Tesla’s growth. Let’s explore how environmental regulations and government incentives play a role.

Environmental Regulations

Environmental regulations push for cleaner energy. They aim to reduce carbon emissions worldwide. Tesla benefits from these regulations. Why? Because their electric vehicles produce zero emissions. As governments enforce stricter rules, demand for Tesla cars may rise. This could positively impact Tesla’s stock by 2025. More countries are setting goals for green energy. Tesla stands to gain from this shift.

Government Incentives

Governments offer incentives to promote green technology. These incentives include tax breaks and rebates. Tesla can take advantage of these benefits. Such incentives make electric cars more affordable. This increases the number of potential Tesla buyers. More sales can boost Tesla’s stock. Countries like the United States and China support electric vehicles. Tesla’s market could grow significantly due to these incentives.

Credit: seekingalpha.com

Tesla’s Strategic Plans

Tesla’s strategic plans are pivotal for its future growth. These plans focus on expanding its market presence and introducing innovative products. By understanding these strategies, investors can better predict Tesla’s stock forecast for 2025. Let’s delve into Tesla’s key strategies.

Expansion Goals

Tesla aims to increase its production capacity. The company plans to build new Gigafactories in different regions. This will help meet the growing demand for electric vehicles. Expanding to new markets is also a priority. Tesla wants to strengthen its presence in Europe and Asia. These regions offer significant growth potential.

New Product Launches

Tesla plans to introduce several new models by 2025. The highly anticipated Cybertruck will enter the market soon. This electric pickup truck has generated a lot of interest. Another key product is the Tesla Semi. It promises to revolutionize the trucking industry. Additionally, the new Roadster will target high-performance car enthusiasts. These new launches will likely boost Tesla’s market share.

Risks And Challenges

Predicting the Tesla stock forecast for 2025 is complex. The electric vehicle industry is evolving rapidly. Many factors can influence stock performance. Risks and challenges are key aspects to consider.

Market Competition

The electric vehicle market is becoming crowded. Many companies are entering the scene. Established automakers are launching their electric models. This increases competition for Tesla. New technologies are also emerging. These could impact Tesla’s market share. Competition from companies like Rivian and Lucid Motors is intense. They are producing innovative vehicles. This could affect Tesla’s dominance.

Supply Chain Issues

Supply chain disruptions are a major concern. The COVID-19 pandemic has shown this. Raw materials for electric vehicles are in high demand. Battery production is a key factor. Any disruption can affect Tesla’s production. Semiconductor shortages are also a challenge. These components are essential for modern vehicles. Delays in supply can impact delivery timelines.

Conclusion

Tesla’s stock forecast for 2025 remains a topic of interest. Predictions vary widely. Investors should stay informed and watch market trends closely. Consider consulting financial experts for advice. The future holds both potential and risks. Making informed decisions is crucial.

Stay updated with the latest news. Keep your investment goals in mind. The electric vehicle market continues to evolve. Tesla’s innovations might impact its stock value. Always research thoroughly before investing.